| Let’s be honest. Something about the phrase “fill out this form” gets our insides all in a twist. It sounds so ominous and so unnecessarily complicated. For the veterans who spend their lives regurgitating their own date of birth, social security number, or any other snooze fest question faster than Mario Andretti taking a corner on the track, it’s B-O-R-I-N-G.

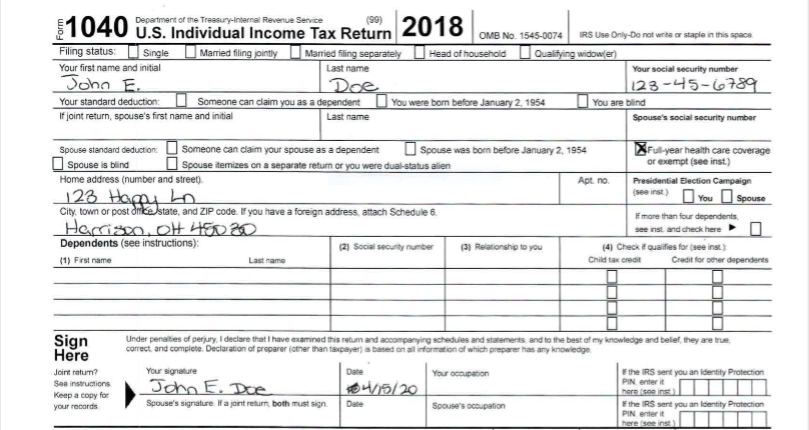

Nothing makes me more jittery than staring down at a W-4 Form and wondering what in the world to put down, or worse yet, if I filled it out correctly. (And I’m also wondering if the federal government has some mercy because it’s the new year and I’m still recovering from my post-Thanksgiving and post-Christmas food coma). My boss, God bless him, gave me the best advice for filling out the W-4 Form that made me sing the Hallelujah chorus from Handel’s Messiah. It made life much simpler. I was done in minutes whereas before, it took me 30 (ridiculous) minutes to fill it out. You can totally skip filling out the entirety of the W-4 if you only do the following couple of things. Step 1: Have your prior year income tax return in front of you (what we refer to here as a form 1040. It looks like this).

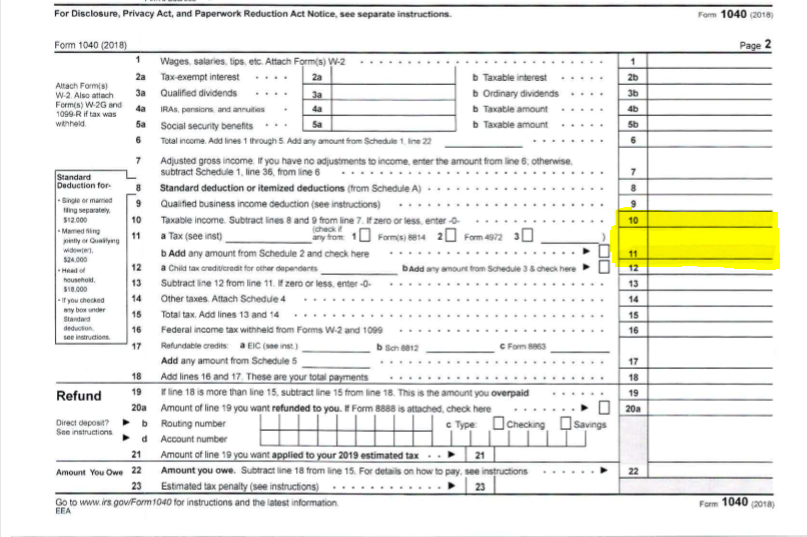

Now we add one small math calculation into the mix… Step 2: On page 2 of your 1040, locate line 11 on your 1040 and divide by the income on line 10.

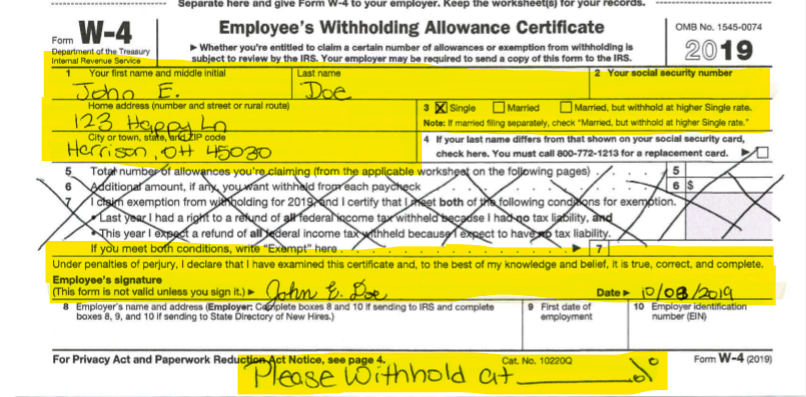

Step 3: Fill out your name, address, and social security number, and sign the W-4 form. Step 4: Find yourself a good pen and write the following on your W-4: Please withhold my Federal Income Tax at ____%.

And that’s it. That’s all you need to do to fill out your W-4 Form. I hope you’re able to join me in singing the Hallelujah chorus. And I hope this trick made your life simpler when it comes to starting your year off right by taking some advice to turn a mountain into a mole hill from Shank & Company, CPA. |

Personal Tax Advice

A CPA’s Educational Response to Ceasing Social Security Tax on Tip Income

While the idea of not taxing tip income for Social Security may sound appealing, particularly for those who receive tip income, the impacts are the least beneficial for those taxpayers. Let’s understand what removing Social Read more…